Steps To Aid You Purchase Gold and the Supposition For Gold Costs

Content written by-Kaufman Holck

Gold is no question one of the most extensively traded metal on the planet. It is an extensively acknowledged kind of investment worldwide. Gold has been called "the cash commodity" because it has actually been traded as a product throughout the centuries. Gold is taken into consideration a hedge versus inflation and national debt by capitalists all over the world. Recently, gold has actually obtained in worth as well as appeal, particularly in the United States where the buck has deteriorated against many currencies. Over the last years, gold mining supplies have actually grown virtually significantly in the United States alone.

Gold bullion and also coins are a preferred financial investment for both private financiers as well as governmental profiles. Gold investment uses greater returns than buying supplies and mutual funds. Of all the offered rare-earth elements, gold is without a doubt the most popular as a main investment. Most financiers normally purchase gold as a way of expanding their risk, specifically via using derivatives and futures agreements.

Gold bars as well as coins are an additional prominent investment choice for both personal as well as governmental profiles. Gold bars are acquired as well as kept in bars, Troy ounces, or coins. Buying bars needs substantial in advance investments; nevertheless, since gold bullion and also coins are marketed in physical amounts, they offer the possible to benefit gradually. On top of that, the trading of gold bars and also coins takes place every day, which makes sure that investors can adhere to the motions of the marketplace as it takes place.

Gold bullion and coins are traded on futures exchanges. Gold is bought and sold at vault accounts that lie throughout the world. Gold is traded on significant futures exchanges such as COMEX, NYMEX, as well as futures trading systems. Significant financial institutions trade gold bullion as well as coins on UNITED STATE exchanges as well as futures exchanges consisting of COMEX.

The greatest benefit of purchasing gold is its ability to track the price of gold consistently with time. Gold rates are often upgraded as well as can be seen quickly online. Gold rates are upgraded on a 24-hour basis through press release as well as other media resources. Capitalists can also receive regular updates from brokers on the gold costs as well as market movements. Through https://www.marketwatch.com/story/these-money-and-investing-tips-can-help-you-when-inflation-is-burning-a-hole-in-your-wallet-2021-05-15 , capitalists can evaluate their profile's well worth, particularly in an unpredictable market.

Gold has actually been recognized as one of the best financial investment properties and also a preferred asset course among specialists. Its high liquidity and also somewhat low cost have actually made it a favorite of lots of corporate investors and also loan provider. It is commonly traded in futures markets. Gold rates are additionally conscious government policies and its supply and also need position in the overall economic situation.

There are various advantages of purchasing gold. First, the price of gold tends to change. It can increase or drop promptly depending on federal government plans or other outside elements. Gold has been identified to be a safe house by numerous specialist investment firm. Second, gold has considerable historical returns. Gold is commonly much more stable than stocks and bonds and also is considered a strong bush against inflation.

Gold can be purchased from licensed gold provider. Purchasing from a physical shop can be costly. A lot of online acquisitions are generally reduced in expense. Among the very best means to acquire this preferred and secure property is to purchase gold through a provider who has a solid track record for high quality service and financial investment products.

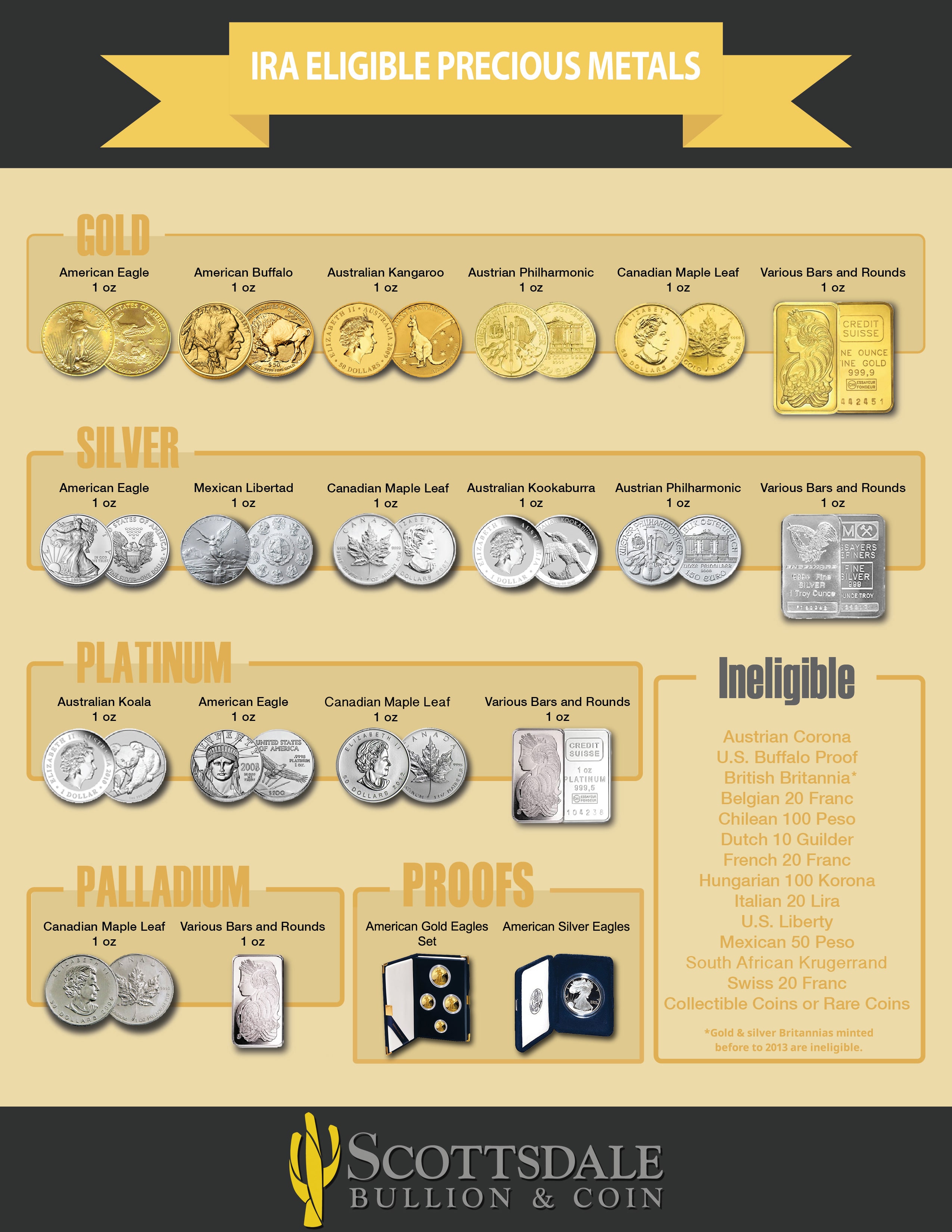

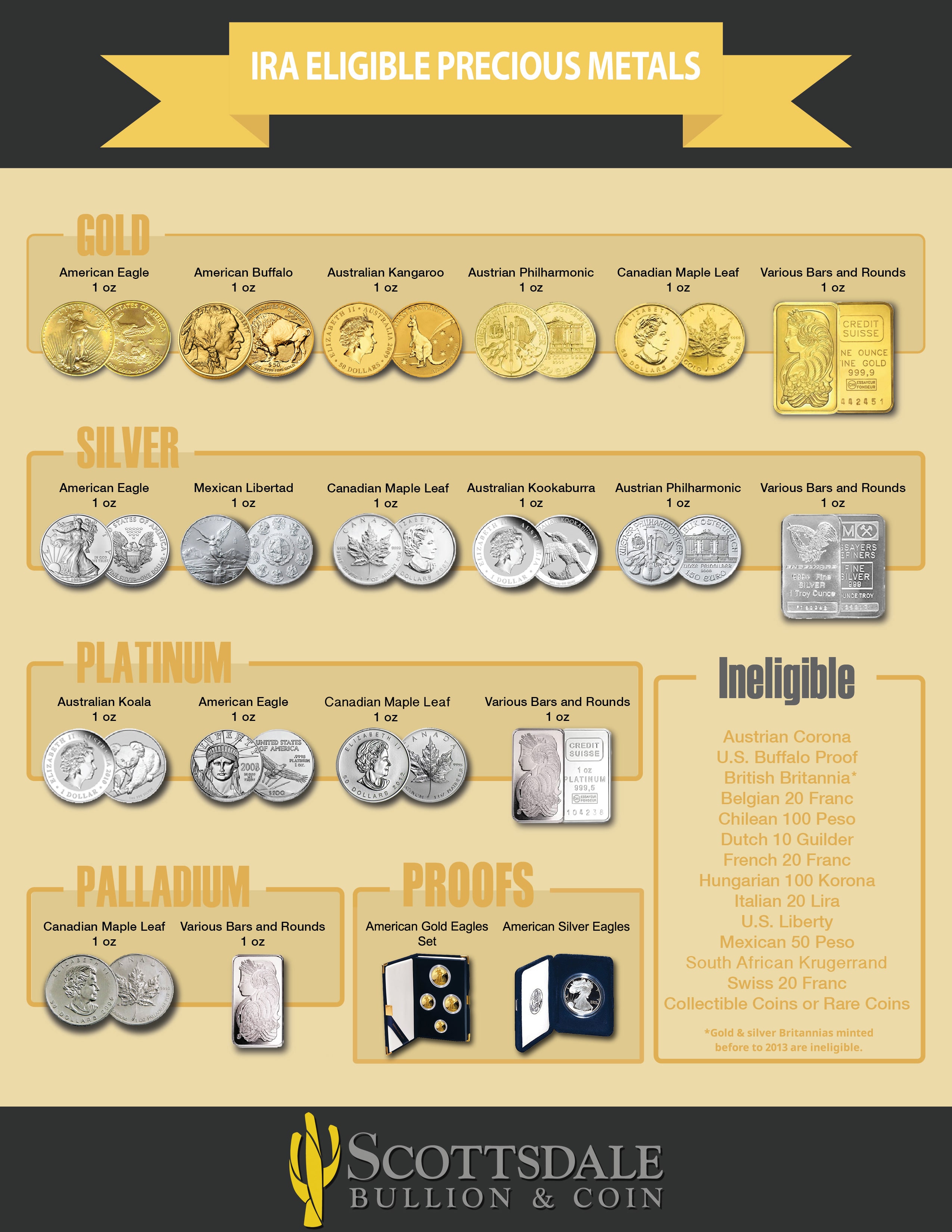

An excellent Gold Service Provider will assist you achieve monetary goals by building a diversified profile that includes physical gold, supplies, as well as bonds. This makes certain that your whole investment portfolio is invested in one solid steel. A Gold Service Provider can likewise assist you achieve a great return on your financial investment. They ought to have the ability to offer a complete range of financial products consisting of Gold IRA's, Gold Stock Options, Person Bond Investments, and Gold ETF's. They ought to likewise have a tried and tested system to handle your mutual fund.

There are two kinds of Gold Investors: institutional and private financiers. Best Way To Invest In Gold . A specific financier is generally a rich person with substantial savings. A lot of investors favor to purchase Gold as an alternative to common supply financial investments. The best method to determine which sort of financier is right for you depends upon your objectives, financial needs, and also resistance for danger.

Gold can be purchased from Gold Expert, financial institutions, or other accredited suppliers. Some individuals select to invest directly in Gold ETF's. In either case, it is very important that you buy your Gold from a reputable supplier. Numerous knowledgeable capitalists pick to use a broker to help them in their investing endeavors. They assist take care of the portfolio, set premiums and also margins, and also offer information on the most up to date gold rates and also news.

Gold is no question one of the most extensively traded metal on the planet. It is an extensively acknowledged kind of investment worldwide. Gold has been called "the cash commodity" because it has actually been traded as a product throughout the centuries. Gold is taken into consideration a hedge versus inflation and national debt by capitalists all over the world. Recently, gold has actually obtained in worth as well as appeal, particularly in the United States where the buck has deteriorated against many currencies. Over the last years, gold mining supplies have actually grown virtually significantly in the United States alone.

Gold bullion and also coins are a preferred financial investment for both private financiers as well as governmental profiles. Gold investment uses greater returns than buying supplies and mutual funds. Of all the offered rare-earth elements, gold is without a doubt the most popular as a main investment. Most financiers normally purchase gold as a way of expanding their risk, specifically via using derivatives and futures agreements.

Gold bars as well as coins are an additional prominent investment choice for both personal as well as governmental profiles. Gold bars are acquired as well as kept in bars, Troy ounces, or coins. Buying bars needs substantial in advance investments; nevertheless, since gold bullion and also coins are marketed in physical amounts, they offer the possible to benefit gradually. On top of that, the trading of gold bars and also coins takes place every day, which makes sure that investors can adhere to the motions of the marketplace as it takes place.

Gold bullion and coins are traded on futures exchanges. Gold is bought and sold at vault accounts that lie throughout the world. Gold is traded on significant futures exchanges such as COMEX, NYMEX, as well as futures trading systems. Significant financial institutions trade gold bullion as well as coins on UNITED STATE exchanges as well as futures exchanges consisting of COMEX.

The greatest benefit of purchasing gold is its ability to track the price of gold consistently with time. Gold rates are often upgraded as well as can be seen quickly online. Gold rates are upgraded on a 24-hour basis through press release as well as other media resources. Capitalists can also receive regular updates from brokers on the gold costs as well as market movements. Through https://www.marketwatch.com/story/these-money-and-investing-tips-can-help-you-when-inflation-is-burning-a-hole-in-your-wallet-2021-05-15 , capitalists can evaluate their profile's well worth, particularly in an unpredictable market.

Gold has actually been recognized as one of the best financial investment properties and also a preferred asset course among specialists. Its high liquidity and also somewhat low cost have actually made it a favorite of lots of corporate investors and also loan provider. It is commonly traded in futures markets. Gold rates are additionally conscious government policies and its supply and also need position in the overall economic situation.

There are various advantages of purchasing gold. First, the price of gold tends to change. It can increase or drop promptly depending on federal government plans or other outside elements. Gold has been identified to be a safe house by numerous specialist investment firm. Second, gold has considerable historical returns. Gold is commonly much more stable than stocks and bonds and also is considered a strong bush against inflation.

Gold can be purchased from licensed gold provider. Purchasing from a physical shop can be costly. A lot of online acquisitions are generally reduced in expense. Among the very best means to acquire this preferred and secure property is to purchase gold through a provider who has a solid track record for high quality service and financial investment products.

An excellent Gold Service Provider will assist you achieve monetary goals by building a diversified profile that includes physical gold, supplies, as well as bonds. This makes certain that your whole investment portfolio is invested in one solid steel. A Gold Service Provider can likewise assist you achieve a great return on your financial investment. They ought to have the ability to offer a complete range of financial products consisting of Gold IRA's, Gold Stock Options, Person Bond Investments, and Gold ETF's. They ought to likewise have a tried and tested system to handle your mutual fund.

There are two kinds of Gold Investors: institutional and private financiers. Best Way To Invest In Gold . A specific financier is generally a rich person with substantial savings. A lot of investors favor to purchase Gold as an alternative to common supply financial investments. The best method to determine which sort of financier is right for you depends upon your objectives, financial needs, and also resistance for danger.

Gold can be purchased from Gold Expert, financial institutions, or other accredited suppliers. Some individuals select to invest directly in Gold ETF's. In either case, it is very important that you buy your Gold from a reputable supplier. Numerous knowledgeable capitalists pick to use a broker to help them in their investing endeavors. They assist take care of the portfolio, set premiums and also margins, and also offer information on the most up to date gold rates and also news.

Created at 2021-05-27 15:22

Back to posts

This post has no comments - be the first one!

UNDER MAINTENANCE